Leasing Market In 2029

The Business Research Company's Leasing Global Market Report 2026 – Market Size, Trends, And Global Forecast 2026-2035

LONDON, GREATER LONDON, UNITED KINGDOM, January 6, 2026 /EINPresswire.com/ -- "Leasing Market to Surpass $3,003 billion in 2029. Within the broader Services industry, which is expected to be $23,934 billion by 2029, the Leasing market is estimated to account for nearly 13% of the total market value.

Which Will Be the Biggest Region in the Leasing Market in 2029

Asia Pacific will be the largest region in the leasing market in 2029, valued at $990 billion. The market is expected to grow from $559 billion in 2024 at a compound annual growth rate (CAGR) of 11%. The rapid growth can be attributed to the increase in cross-border trade and increasing partnership agreements.

Which Will Be The Largest Country In The Global Leasing Market In 2029?

The USA will be the largest country in the leasing market in 2029, valued at $873 billion. The market is expected to grow from $645 billion in 2024 at a compound annual growth rate (CAGR) of 6%. The strong growth can be attributed to the rising government initiatives and the growth of tourism and hospitality sector.

Request a free sample of the Leasing Market report

https://www.thebusinessresearchcompany.com/sample_request?id=1945&type=smp

What will be Largest Segment in the Leasing Market in 2029?

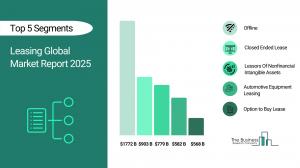

The leasing market is segmented by type into automotive equipment leasing, consumer goods and general rental centers, machinery leasing, lessors of nonfinancial intangible assets. The lessors of nonfinancial intangible assets market will be the largest segment of the leasing market segmented by type, accounting for 37% or $1,115 billion of the total in 2029. The lessors of nonfinancial intangible assets market will be supported by increasing monetization of intellectual property assets such as patents and trademarks, the growth of licensing in entertainment and media sectors, rising awareness about intangible asset valuation, demand from startups and small enterprises for brand or software licensing, growth of franchising in retail and food sectors, rising number of copyright leasing in digital content creation and expanding usage of intangible assets in AI and research-based industries.

The leasing market is segmented by mode into online and offline. The offline market will be the largest segment of the leasing market segmented by mode, accounting for 83% or $2,482 billion of the total in 2029. The offline market will be supported by strong customer trust in face-to-face interactions, personalized leasing consultations and negotiation flexibility, established physical presence in key commercial zones, preference of older demographic groups for traditional channels, ability to inspect and experience assets physically before leasing, relationship-based leasing for B2B clients and longer lease terms typically offered through offline agreements.

The leasing market is segmented by lease type into closed ended lease, option to buy lease, sub-vented lease, other lease types. The closed ended lease market will be the largest segment of the leasing market segmented by lease type, accounting for 44% or $1,310 billion of the total in 2029. The closed ended lease market will be supported by fixed-term usage plans offering budget certainty for lessees, no residual value risk on asset return, appeal to individual consumers seeking hassle-free leasing, predictability in cash flows for businesses, popularity in automotive and equipment leasing, reduced liability on asset resale and simplified accounting treatment for users.

What is the expected CAGR for the Leasing Market leading up to 2029?

The expected CAGR for the leasing market leading up to 2029 is 10%.

What Will Be The Growth Driving Factors In The Global Leasing Market In The Forecast Period?

The rapid growth of the global leasing market leading up to 2029 will be driven by the following key factors that are expected to reshape asset financing models, capital-efficient business operations, and enterprise equipment acquisition strategies worldwide.

Rising Cost of Capital Assets - The rising cost of capital assets will become a key driver of growth in the leasing market by 2029. The increasing cost of capital assets is driving the growth of the leasing market, as businesses seek alternatives to large upfront investments. When the price of equipment, vehicles, or technology rises, companies, especially small and medium-sized enterprises, often turn to leasing to access essential assets without depleting their working capital. For example, in the construction and healthcare sectors, leasing allows firms to use advanced machinery or medical equipment while spreading payments over time, rather than making substantial one-time purchases. This approach helps businesses maintain operational flexibility and preserve cash flow, which is critical in times of economic uncertainty or inflation. As a result, the rising cost of capital assets is anticipated to contributing to a 2.0% annual growth in the market.

Increase In Cross-Border Trade - The increase in cross-border trade will emerge as a major factor driving the expansion of the leasing market by 2029. The rise in cross-border trade is driving the growth of the leasing market, as it enables businesses to access a broader range of assets and financing options across international boundaries. Businesses involved in international trade prefer leasing to manage fluctuating shipment volumes cost-effectively. Leasing offers flexibility and scalability without heavy capital investment in multiple regions. It also helps companies navigate regulatory and operational differences across countries. Consequently, the increase in cross-border trade capabilities is projected to contributing to a 1.5% annual growth in the market.

Rising Government Initiatives - The rising government initiatives within digital manufacturing processes will serve as a key growth catalyst for the leasing market by 2029. Rising government initiatives significantly expanded the growth of the leasing market by creating a more favorable regulatory and financial environment for both lessors and lessees. Subsidies, tax benefits and policy support make leasing more accessible for businesses. Public-private partnerships often rely on leased equipment for efficiency and cost control. These initiatives not only lower financial barriers but also provide regulatory clarity, making leasing a more attractive option for businesses and individuals. Therefore, this rising government initiatives across digital manufacturing operations is projected to supporting to a 1.0% annual growth in the market.

Growing Tourism and Hospitality - The growing tourism and hospitality will become a significant driver contributing to the growth of the leasing market by 2029. The rapid expansion of the tourism and hospitality sector driving the growth of the leasing market, as increased tourist inflows create higher demand for leased assets such as vehicles, hotels and commercial properties. Hotels and resorts often lease furniture, electronics and kitchen appliances to reduce upfront costs. Car rental and transportation services lease vehicles to meet tourist demand efficiently. Seasonal fluctuations in tourism make flexible leasing options more appealing. Consequently, the growing tourism and hospitality strategies is projected to contributing to a 0.5% annual growth in the market.

Access the detailed Leasing Market report here:

https://www.thebusinessresearchcompany.com/report/leasing-global-market-report

What Are The Key Growth Opportunities In The Leasing Market in 2029?

The most significant growth opportunities are anticipated in the offline leasing market, the closed-ended leasing market, and the leasing of nonfinancial intangible asset market. Collectively, these segments are projected to contribute over $1,752 billion in market value by 2029, driven by rising demand for flexible asset-acquisition models, expanding adoption of lease-based financing across commercial and consumer sectors, and the growing monetization of intangible assets such as trademarks, patents, and digital IP. This surge reflects the accelerating shift toward capital-efficient business models that reduce upfront costs, optimize balance sheets, and support scalable asset utilization. As enterprises and individuals increasingly Favor leasing over ownership to enhance liquidity and operational agility, these segments are poised to fuel transformative growth within the broader global leasing industry.

The offline leasing market is projected to grow by $860 billion, the closed-ended leasing market by $490 billion, and the leasing of nonfinancial intangible asset market by $402 billion over the next five years from 2024 to 2029.

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. We have published over 17,500 reports across 27 industries and 60+ geographies. Our research is powered by 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

We provide continuous and custom research services, offering a range of specialized packages tailored to your needs, including Market Entry Research Package, Competitor Tracking Package, Supplier & Distributor Package and much more

Disclaimer: Please note that the findings, conclusions and recommendations that TBRC Business Research Pvt Ltd delivers are based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such TBRC Business Research Pvt Ltd can accept no liability whatever for actions taken based on any information that may subsequently prove to be incorrect. Analysis and findings included in TBRC reports and presentations are our estimates, opinions and are not intended as statements of fact or investment guidance.

The Business Research Company

Americas +1 310-496-7795

Europe +44 7882 955267

Asia & Others +44 7882 955267 & +91 8897263534

Email: info@tbrc.info"

Oliver Guirdham

The Business Research Company

+44 7882 955267

info@tbrc.info

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.